Generally you should think of the amount in Box 1 as the maximum that can be excluded from income not taxable and the amount in Box 5 as the scholarships grants and fellowships of which the college is aware. The student made 6K in part time income over the summer and we were going to file his return to claim back refunds 100-200.

1098 T Form Financial Management Services

In many of the cases where scholarships end up being taxable the tuition is paid in full and thereby a Form 1098-T is not required.

Scholarship 1098-t taxable. There also is a tax credit that may be available to students for independent students or your parents for dependent students if you got a Form 1098-T from your college. What part of a scholarship is taxable. If the amount is determined to be taxable and it was not reported on Form W-2 access Screen Income in the Income folder and open the Other income statement dialog.

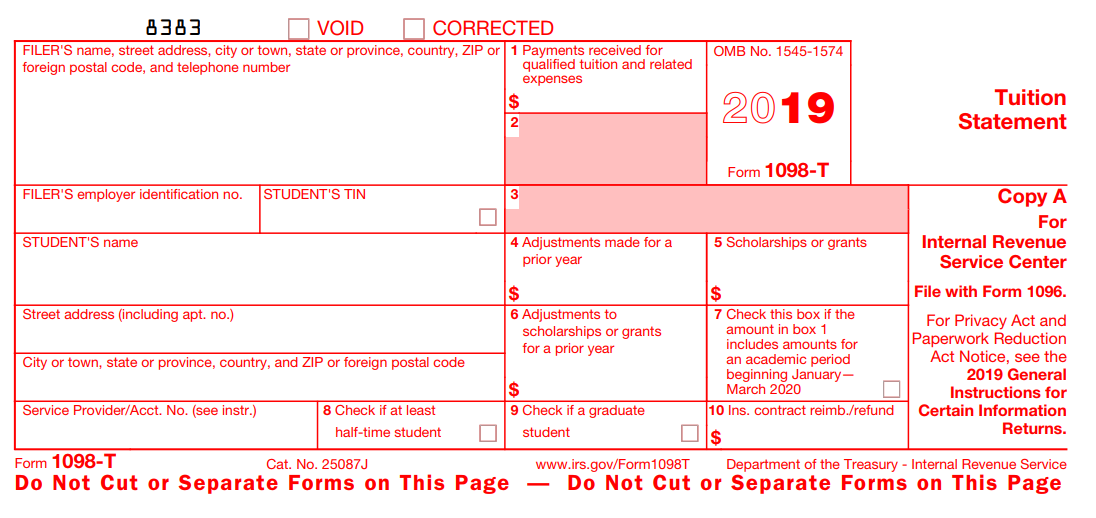

The 1098-T form is provided to help students and parents determine eligibility for an American Opportunity Tax Credit or a Lifetime Learning Credit and it should not be used to calculate taxable income. Qualified expenses include tuition any fees that are required for enrollment and course materials required for a student to be enrolled at or attend an eligible educational institution. How is Form 1098-T Box 5 reported.

But if you actually paid more in tuition than the school shows in box 2 you can show that in TurboTax by clicking What if. Youll use the information from Form 1098-T to report your scholarship or grant income plus any expenses paid to. TurboTax asks in the next step if that is the case for your 1098-T because the bill and scholarships can be pulled into the same tax year.

To determine if the amount in Box 5 is taxable or not refer to Publication 970 Tax Benefits for Education. If youre a full-time or part-time student for a degree at a qualifying educational institution your scholarship or fellowship is tax-free. Form 1098-T is used by eligible educational institutions to report for each student the enrolled amounts they received for qualified tuition and related expense payments.

You can if you want but the only output that matters is that the taxable amount ends up on line 7 of the 1040. Are 1098 t scholarships taxable. You simply enter the taxable amount in the education section as a scholarship on his return.

The student will pay taxes on the amount of scholarshipsgrants that. It may be a school that is primary secondary or post-secondary although what the award can be used for and still be tax-free. A fellowship is the same thing as a scholarship for tax purposes.

So even though the intent of the 1098-T may not be to determine tax status of scholarships since I paid his bill Dec 18 for Spring 19 semester the 2019 1098-T shows 0 paid for the year. You must report the excess as taxable income on your federal return. If the amount in Box 5 your scholarships is GREATER THAN the amount in Box 1 or Box 2 whichever is filled in on your 1098-T then you cannot use any expenses to reduce your tax bill.

Filing a tax return online with TaxSlayer is straightforward and college students can typically file for free using TaxSlayers Simply Free option. And he owes tax on the scholarship even though his actual tuition paid was greater than the scholarship. In addition the educational institution will most likely report any scholarship that is received by the institution but there may be situations where the scholarship is received directly by the student and not reported to the institution.

Theres no specific field to enter scholarships fellowships or grants received on a Form 1098-T box 5. Eligible colleges or other post-secondary institutions must send Form 1098-T to any student who paid qualified educational expenses in the preceding tax year. I am encountering some scenarios on College Students who received 1098-T with scholarships.

Information about Form 1098-T Tuition Statement including recent updates related forms and instructions on how to file. You dont need to enter the 1098-T and go through all the steps. Thus the amounts reported on IRS Form 1098-T are a guide that can help you figure out the taxable portion of your scholarships grants and fellowships but not necessarily a definitive answer.

If the scholarshipsgrants exceed the qualified education expenses then the student will report the 1098-T and all other educational expenses and scholarshipsgrants on the students tax return. To do this within the program please go to. That means net 4531 have to be paid out of pocket.

How do I report a scholarship on my taxes. Elementary and secondary school scholarships and bursaries are not taxable. Scholarships Fellowships and 1098-T Tax Reporting Scholarships and fellowships may be taxable or tax exempt.

Scholarships fellowships or grants will continue to be reported in Box 5. The hypothetical students 1098-T doesnt have this issue but consider if yours does eg the amount in Box. 1 1098-T shows Box 1 20K and Box 5 15811.

The IRS has an online assistant you can use to decide how much of your scholarships if any are taxable. The credit is called the American Opportunity Tax Credit AOTC. Qualified scholarships are tax.

But nontaxable scholarships may reduce the amount of education expenses eligible youre eligible to claim for education credits and the tuition deduction and taxable scholarships need to.

1098 T Niner Central Unc Charlotte

Tuition Statement Form 1098 T What Is It Do You Need It

1098 T Tax Reporting Bursar S Office

Form 1098 T Still Causing Trouble For Funded Graduate Students Personal Finance For Phds

Understanding The 1098 T Form Graduate School

Form 1098 T Information Student Financial Services Csusm

Tuition Statement Form 1098 T What Is It Do You Need It

0 comments:

Post a Comment