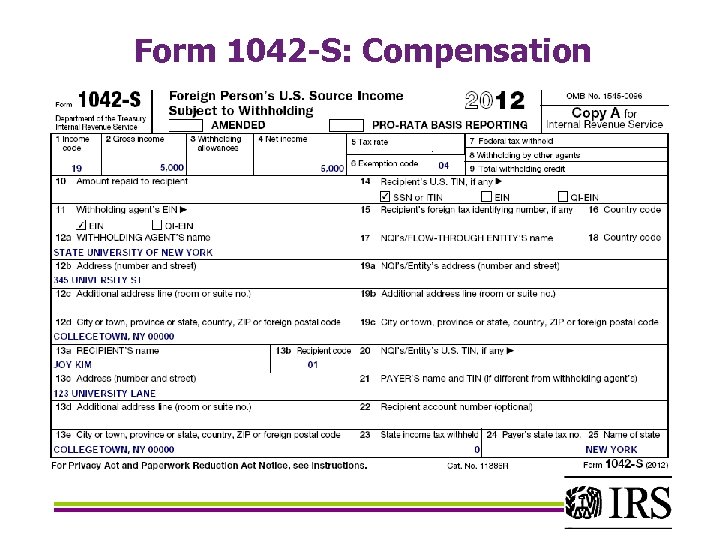

Source Income Subject to Withholding Go to wwwirsgovForm1042S for instructions and the latest information. Students who earn income by working received form W-2 Scholarship and received form 1042-S or any kind of income need to file form 1040NR instead form 1040 because form1040 is for the people who qualify for SPT and also who are on H1B L1 Green Card Holders and Citizen.

Internal Revenue Service Wage And Investment Stakeholder Partnerships

A tax treaty may apply that would make this exempt from taxes.

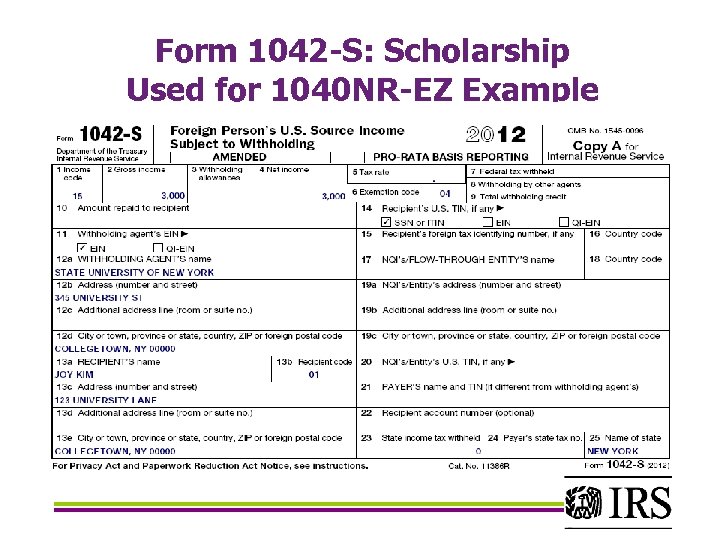

1042-s scholarship. Students who have paid a scholarship tax will need to file both an 8843 Form and a 1040-NR Form. This amount is subject to 14 federal tax withholding. UC Berkeley is required to send the 1042-S to eligible participants no later than March 15 2021.

It can also apply to real estate income pensions royalties and more of the following. Source Income Subject to Withholding. For Internal Revenue Service.

WA subjects the remaining 50 of interest to 30 withholding under chapter 4 and reports the interest on a Form 1042-S by treating NQI as the recipient in Box 13a and uses chapter 3 status code 25 nonqualified intermediary chapter 4 status code 43 recalcitrant pool US. All exempt income per a tax treaty benefit and non-service fellowship income subject to taxation along with taxes withheld will be reported to foreign individuals on IRS Form 1042-S Foreign Persons US. Received wages exempted from federal and state tax withholding by a tax treaty.

Per IRS you are required to file a Form 1040 to report your scholarship amount along with your tuition. WA includes information relating to NQI in Boxes 15a through 15i on the Forms 1042-S for A and B. UNIQUE FORM IDENTIFIER AMENDED.

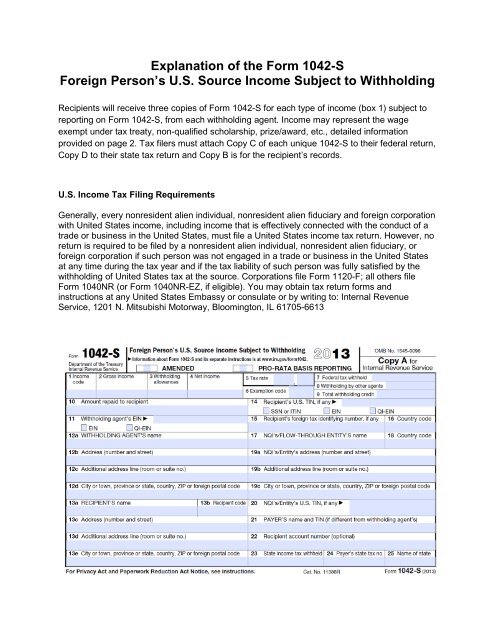

Form 1042-S is used to report amounts paid to foreign persons including persons presumed to be foreign that are subject to tax withholding even if no amount is deducted and withheld from the payment because of a treaty or exception to taxation or if any amount withheld was repaid to. Form 1042-S is often used to report scholarships and fellowship grants that foreign students receive from US. Reporting required on a 1042.

A 1042-S is a year-end federal tax document given to a non-resident alien who. Source Income Subject to Withholding is used to report any payments made to foreign persons. 1042-S Department of the Treasury Internal Revenue Service Foreign Persons US.

This is available under Deduction and Credits. A nonqualified scholarship is an amount issued for any other purpose including travel room board research etc. A scholarship or fellowship grant paid to a nonresident alien NRA of the United States may or may not be subject to withholding andor reporting on Form 1042-S.

The 1042-S form can also be used to document scholarship fellowship grant or wage income that is exempt from tax withholding because of a tax treaty. Indicia 3000 in Box 4b chapter 4. If you are a US resident by receiving a Form 1042- S with the code 16 you will treat it as receiving a scholarship or fellowship to offset your qualified education expenses if there are any.

Taxable non-qualified scholarships fellowships and grants charged as ITAX on a student bill Tax exempt non-scholarships fellowships and grants exempt due to a tax treaty benefit. Andor Received a non-qualified taxable scholarship Any amounts received for incidental expenses or by a. Income Reported on a 1042-S.

Compensation from services conducted in the US. Form 1042-S - Box 1 Code 16 Scholarship or Fellowship Income. 1042-S for Scholarship and Fellowship Income.

The Office of International Taxation generates a Form 1042-S for each individual NRA who will be required to report withholding. And What Is Form W2 1042-S Scholarship 1099. You will be notified by email when it becomes available in your Glacier record.

Source Income of Foreign Persons are IRS tax forms that deal specifically with payments to nonresident aliens and other foreign persons. From what I understand from my extensive reading of this forum - if you received 1042-S income code 15 that is scholarshipfellowship for which you have already paid state and income tax report the income as a scholarship on turbo tax. Forms 1042-S and 1042 Annual Withholding Tax Return for US.

Form 1042-S Foreign Persons US. If your scholarship fellowship or grant exceeds the costs of required tuition fees books supplies and equipment then the excess is taxable income which you are required to report to the IRS on your income tax return. A scholarship or fellowship grant is an amount given to an individual for study training or research and which does not constitute compensation for personal services.

Students whose scholarship has been taxed will receive a 1042-S form from the school which issued them the scholarship usually during the February after the year when the scholarship was rewarded. Both forms are due by the tax day deadline.

Ppt International Students Income Tax Seminar Powerpoint Presentation Id 6916785

Form 1042 S Explained Foreign Person S U S Source Income Subject To Withholding William Mary

Explanation Of The Form 1042 S Foreign Person S U S Source

Https Sfsd Mt Gov Sab Trainingmaterials 1042 Training 2020 Slides Pdf

Pin By Euphoriagirl07 On S T U D Y I N G Video High School Life Hacks School Hacks Student Hacks

Internal Revenue Service Wage And Investment Stakeholder Partnerships

Template For Trust Distribution Letter Of Instructions Collection Inside Estate Distribution Letter Template 10 P Professional Templates Lettering Templates

Understanding Your 1042 S Payroll Boston University

0 comments:

Post a Comment