If you are under the age of 24 on December 31 and a student your unearned income exceeding 2200 may be subject to a higher tax rate than the ordinary rate. 117 allows scholarships for tuition and fees required for attendance and other fees and expenses required for courses to be excluded from federal income tax including the kiddie tax.

Irs Announces 2014 Tax Brackets Standard Deduction Amounts And More Income Tax Brackets Tax Brackets Federal Income Tax

The kiddie tax is a tax imposed on individuals under a certain age under 19 years old and full-time students age 19-23 years old whose investment and unearned income is.

Scholarship kiddie tax. As under prior law the kiddie tax applies to a childs net unearned income if the child is under age 19 or is a full-time student under age 24 has at least one living parent has unearned income above a threshold amount 2200 for 2020 and doesnt file a joint return with a spouse for the year. This method uses the tax rates for trusts and estates instead of parents personal rates. 25 As for earned income however there is a divergence in treatment.

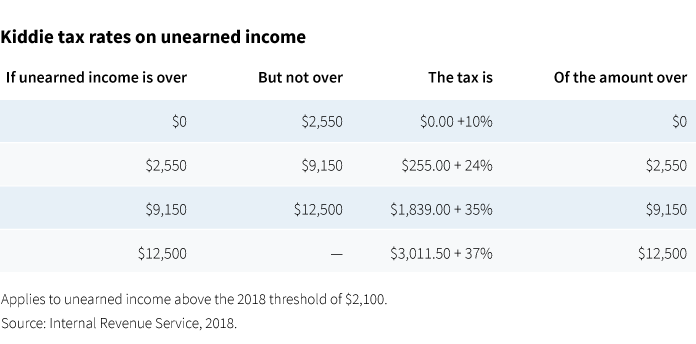

For 2018 and 2019 parents have the choice of calculating their kiddie tax using their personal income tax rates or using the method proscribed by the TCJA. Under the Kiddie Tax rule the first 1100 of a childs unearned income qualifies for the standard deduction. The 2019 rates are shown in the following chart.

Computing Kiddie Tax Once the Net Unearned Income is computed you need to deduct the basic exemption amount of 2200 for Tax Year 2019 2100 for 2018. Scholarships and fellowships do not count as earned income for this purpose. Yes the taxable scholarship money is considered unearned for purposes of the kiddie tax but it is actually considered earned for purposes of calculating the standard deduction allowed under the kiddie tax computation.

You probably entered the1000 scholarship as other income rather than scholarship taxable scholarship is treated as earned income for purposes of the kiddie tax and dependent standard deduction. To be clear Sec. However for purposes of calculating the students standard deduction the scholarship amount over 32000.

For tax year 2019 the first 2600 of taxable income using the estates and trusts brackets and rates as the kiddie tax now does is taxed at 10. As you surmised you do not need to enter the 1098-T as it was all covered by tax free scholarship more on that below. The support test being calculated this way creates a very high bar for funded graduate students as tuition can easily rival or exceed living expenses.

The next 1100 is taxed at the childs. In the case of a child over age 17 the kiddie tax applies only if the childs earned income does not. The resultant taxable income comes out to be 13900.

24 This is true not only for purposes of establishing dependency status but also for determining Kiddie Tax exposure. The kiddie tax and unearned income from scholarships Posted 0712019. The kiddie tax is a tax for certain children who have unearned income of at least 2200 during the tax year.

The kiddie tax comes out to be 2708. The Kiddie Tax was overhauled in the Tax. Amounts from 2600 to 9300 are taxed at 24.

The Kiddie tax is only applicable if the net unearned income is more than the exemption amount. The Kiddie Tax for 2018 and 2019. And its considered unearned for purposes of calculating the support test within the kiddie tax determination.

The Kiddie Tax is designed to stop parents from giving large gifts to their children only to have their children realize gains at a much lower tax rate. So the taxable unearned income is Net Earned Income minus the Exemption. Unearned income up to 2200 shall be the exempt and remaining amount of 11700 shall be taxed as follows.

Scholarships are disregarded as support if the recipient is the child of the taxpayer and a full-time student. Because the scholarship exceeds 32000 the student will have unearned income for the amount received in excess of 32000 that is subject to the kiddie tax. Kiddie Tax Fellowship income counts as unearned income for the purposes of being subject to the Kiddie Tax.

So the low-income student who is on full financial aid has to come up with 936. The Kiddie Tax is a series of provisions that determine how unearned investment income of people under age 19 is taxed. However scholarships that help defray the other costs of attendance such as room and board were and continue to be taxable.

With the rising cost of higher education many of these students are looking forward to receiving some form of scholarships to pay a portion or in some cases all of their tuition. Every fall students all over the country set off to attend various colleges and universities. It was created to close a tax loophole that allowed parents to move income to their children in order to pay lower income tax rates.

Kiddie tax can be calculated as follows. If you do not have earned income totaling at least half of your own support you may be subject to the Kiddie Tax.

Paying For Children S Education Can Be Taxing The Cpa Journal

![]()

New Law Revamps The Kiddie Tax Ds B

What Is The Kiddie Tax And How Does It Work

Will Taxpayers Pay More Or Less Under The New Kiddie Tax Rules Putnam Wealth Management

Paying For Children S Education Can Be Taxing The Cpa Journal

Infographic It S Tax Season And Time To Get Organized To Ensure You File By April 15 This Checklist Helps You Gather Tax Prep Tax Prep Checklist Tax Brackets

New Law Revamps The Kiddie Tax

4 Ways The Kiddie Tax Can Work For You And Your Family Her Wealth

New Law Revamps The Kiddie Tax Ds B

0 comments:

Post a Comment