The 529 plan beneficiary. 10-14-2015 at 737 pm.

Form 1099 Q What To Know Credit Karma Tax

You must determine what part if any of the distribution is taxable before you know what to do with the form.

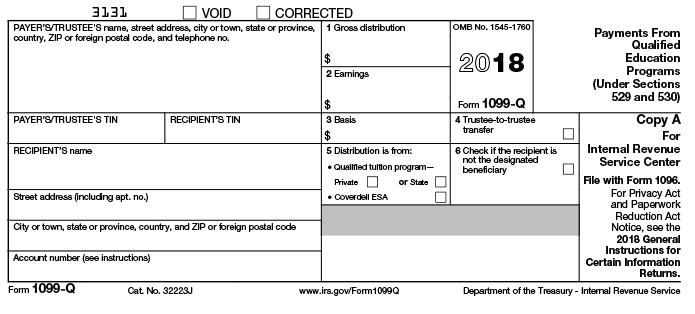

1099-q scholarship. If you received this form the way that you use the distribution will determine whether the income is taxable or not. Includes amount for both Fall 19 and Spring 20 15090 Box 2. Form 1099-Q reports total withdrawals from qualified tuition programs QTPs like 529 plans or Coverdell educational savings accounts.

If you have a scholarship where you are being paid by the National Health Services Corps Scholarship Program or the Armed Forces Health Professions Scholarship and Financial Assistance Program it is not regarded as a taxable income. For both semesters I paid 9073 out of pocket includes 2700 in loans for tuition plus 1646 for bookscomputer. You said that was 15k.

The full amount of earnings as reported on Form 1099-Q is taxable if. The college K-12 school or apprenticeship program the beneficiary attends. Around tax time you might receive a number of 1099 tax forms including Form 1099-Q if you used money from a qualified tuition program or Coverdell ESA to pay for college tuition or other education costs.

Youre the designated beneficiary. 1099-Q in my daughters name with her SS on it reflects 529 withdrawals that were sent directly to the school Box 1. 1098-T will not list RB.

You have two options with how to report your Qualified Education Expenses on Form 1099-Q. FileForm 1099-Q Payments From Qualified Education Programs Under Sections 529 and 530 if you a are an officer or an employee or the designee of an officer or employee having control of a program established by a state or eligible educational institution. When you receive the 1099-Q each year it may be necessary to include some of the amounts it reports on your tax return.

Therefore Im hoping to avoid the auto-generated notices when the disbursements went to someone other than the beneficiary box is checked on the 1099-Q. However does it get reported at all if used for tuition. If so does the 1099-Q show up anyplace on students return.

His gross distribution box 1 was 5000 and his earnings box 2 were 1500. What is IRS Form 1099-Q. Before taking the withdrawal you could change the beneficiary on the account.

If you didnt receive any scholarships or grants the 1098 T will just tell you how much you paid for tuition and fee. I assume it will list the 1750 scholarship. Athletic Scholarships Atheltic Scholarships are not considered as taxable income.

In terms of penalty on the 529 money its probably the scholarship thats preventing the penalty not anything having to do with the credit but you have to manually cross reference between the 1098-T worksheets and the 1099-Q worksheets to get the taxable amount correct. If someone has contributed money to a 529 plan or a Coverdell Education Savings Account Coverdell ESA and designates you as the beneficiary you will receive an IRS Form 1099-Q when you start tapping into those funds. An early withdrawal penalty of 10 applies.

Made a distribution from a qualified tuition program QTP. Qualified expenses are amounts paid for tuition fees and other related expense for an eligible student that are required for enrollment or attendance at an eligible educational institution. Just take the 4000 AOTC tax credit which should yield you 2500.

Form 1099-Q will be issued to the beneficiary student for example if the 529 distribution was paid to the beneficiary the school or a student loan provider. The penalty is reported on Form 5329. So nearly 30000 tuition - 12000 scholarship - 7000 529 distribution still leaves lots for parents to claim AOC yes.

IRS Form 1099-Q is a statement issued by a 529 plan or Coverdell ESA administrator that lists the amount of distributions in a given tax year. Further 529 disbursements went to DS or the school directly. The Form 1099-Q will be issued to the beneficiary if the 529 distribution was paid to.

You dont put the 1098t or 1099Q on either tax return. Student received Form 1099-Q so it gets reported on students return right. About Form 1099-Q Payments from Qualified Education Programs Under Sections 529 and 530 Are an officer or an employee or the designee of an officer or employee having control of a program established by a state or eligible educational institution.

When you will receive 1099-Q The administrator of your qualified tuition plans must send you the Form 1099-Q in any year you take a distribution or transfer funds between accounts. Payments From Qualified Education Programs Form 1099-Q is a tax form sent to individuals who receive distributions from a Coverdell. And b made a distribution from a qualified tuition program QTP.

I checked on this. You didnt use the funds for your own qualified education expenses. It is the same case for services.

You must pay the expenses for an academic period that starts during the tax year or the first three months of the next tax year. To demonstrate we will use the following example. Form 1099-Q is issued for distributions taken from a Qualified Education Program.

Dave received a 1099-Q for a distribution that he received from his QTP Qualified Tuition Program. You should receive the 1099-Q no later than early February following the close of the tax year since the administrator must send it by January 31.

1098 T Tax Reporting Bursar S Office

Stress A Little Less About Paying For College With This University Of Illinois Extension Re Scholarships For College Credit Education Financial Aid For College

Https Cdn Unite529 Com Jcdn Files Ssgav2 Pdfs 1099qfaq Pdf

How To Enter 1099 Misc Fellowship Income Into Turbotax Evolving Personal Finance Evolving Personal Finance

Guide To Irs Form 1099 Q Payments From Qualified Education Programs Turbotax Tax Tips Videos

Next Steps When The First College Bill Is Due Putnam Wealth Management

International Students Nonresident Income Tax Seminar For 2014

Solved Do I Need To Fill Out 1099 Q For Distribution Of M

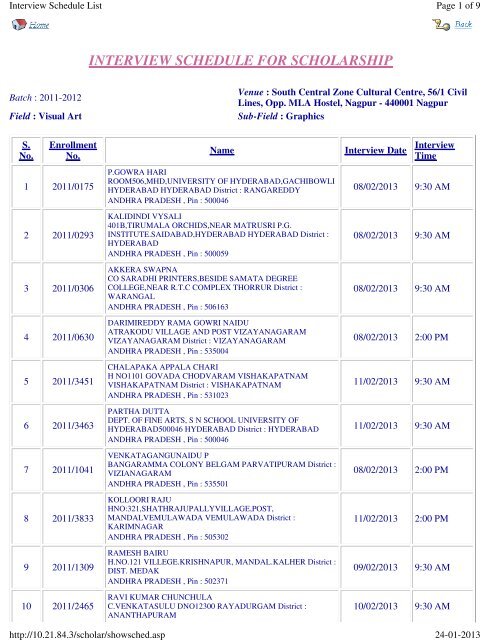

Interview Schedule For Scholarship

0 comments:

Post a Comment